While managing taxes can be a challenging and stressful task for many freelancers, sole traders, and contractors, navigating the world of self-employment offers many rewarding opportunities. It is essential to plan to minimize penalties and optimize your tax savings, as the self-employed tax return submission deadline for the 2024–2025 tax year is January 31, 2026.

Supported by professional insights into UK tax laws and typical pitfalls to avoid, this comprehensive guide will give you helpful self-employed tax tips to save you money in 2025 if you want to keep more of your hard-earned money while staying in compliance.

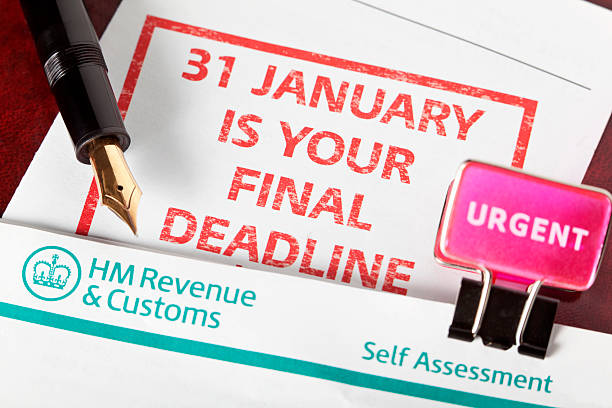

Why Filing Your Self-Employed Tax Returns On Time Matters

The UK tax system requires all self-employed individuals to file an annual self-assessment tax return, which includes an account of their earnings and expenses. This data is used by HM Revenue & Customs (HMRC) to determine your tax obligation. The deadline for filing and paying any taxes due for the 2024–2025 tax year is January 31, 2026.

Automatic penalties apply if this deadline is missed:

- Returns up to three months late are subject to a £100 penalty.

- Increasing daily fines for failure to submit within six to twelve months

- Interest is assessed on any taxes that are not paid by the due date.

These fines can accumulate quickly, causing unnecessary financial hardship. Additionally, missing deadlines may make it more difficult for you to qualify for some tax breaks and benefits. Accurate and timely filing of self-employed tax returns helps you manage your money effectively and prevents penalties and interest.

1. Maintain Accurate and Organized Records Throughout the Year

Maintaining accurate records of all income and business-related expenses is one of the best strategies to lessen stress and save money on your tax return. This comprises:

- Receivables and invoices

- Statements from banks

- Business travel mileage records

- Records of purchases of equipment or supplies for businesses

All allowable expenses that lower your taxable income can be claimed with proper bookkeeping. Additionally, it makes filing your self-employed tax returns easier and offers proof if HMRC inquires.

2. Know Which Expenses Are Allowable and Claim Them Properly

The secret to lowering your taxable profits is knowing which expenses can be deducted from your income. Typical permitted costs consist of:

- Stationery and office supplies

- Costs associated with business travel (fuel, public transportation, lodging)

- Internet and phone bills associated with your company

- Costs of marketing and advertising

- Subscriptions and professional fees

- Using your house as an office accounts for a portion of your household expenses.

Please note that personal expenses are not eligible for claim, and combining business and personal expenses may result in an HMRC investigation. Tax experts can help you claim what is rightfully yours and steer clear of mistakes that could result in penalties if you’re not sure which expenses are allowable.

3. Claim Capital Allowances on Business Assets

You may qualify for capital allowances if you purchase business equipment, such as computers, furniture, or machinery. These allow you to deduct all or a portion of the cost from your pre-tax profits.

This comprises:

- Up to a specific limit, the Annual Investment Allowance (AIA) permits a 100% deduction.

- Making allowances for assets that are not eligible for AIA

- By claiming these, you can significantly lower your tax liability.

4. Consider Your Tax Payments and Plan Cash Flow Accordingly

In addition to filing their tax returns, self-employed people are required to pay their taxes in two installments throughout the year (known as “payments on account”), with the remaining amount being due on January 31. To avoid paying penalties or interest for late payments, it is essential to plan the finances to cover these payments.

If you anticipate that your tax bill will be lower than it was the previous year, you can adjust your account payments accordingly; however, this will require careful planning to prevent an unexpected tax debt.

5. Keep Up to Date with Changing Tax Rules and Allowances

Every year, tax laws are subject to change. For example, there may be differences in tax rates, National Insurance contributions, and personal allowance thresholds. You can minimize surprises and maximize your tax position by being informed.

Every year, HMRC releases guides and updates, but tax experts also offer knowledgeable advice specific to your company.

6. File Your Tax Return Early

You have more time to determine any taxes owed and make arrangements for payments if you file your return early. Additionally, it shields you from fines in the event of unforeseen delays or technical issues near the deadline. It is highly recommended to submit early to prevent last-minute stress and hurried errors.

7. Seek Professional Help When Needed

Many independent contractors and sole proprietors choose to hire accountants or tax advisors due to the complexities of self-employed tax returns and the potential for costly mistakes. Expert services guarantee:

- Accurate filing in compliance with the most recent tax regulations

- Optimization of permissible costs and benefits

- Serving as your representative to communicate with HMRC on your behalf

- Help with trade or profession-specific deductions.

Numerous providers, including those specializing in self-employed industries, offer fixed-fee packages that start at competitive prices, providing you with upfront cost clarity.

How Quick Tax Returns Can Help You

Our area of expertise at Quick Tax Returns is helping independent contractors with their self-employment tax returns. You can get assistance navigating the intricacies of self-assessment tax filings from our team of knowledgeable tax specialists. Our fixed-fee service, which is specifically designed for freelancers and sole traders, starts at £200.

We manage all correspondence on your behalf as your official Agent with HMRC, allowing you to focus on expanding your company. Our expertise not only helps you meet deadlines but also ensures you claim all eligible allowances to save money on your taxes in 2025.

How Expert Support Simplifies Your Tax Journey

Using a specialized tax service can be an invaluable asset if you find the tax filing process difficult or time-consuming.

They offer:

- Thorough evaluations to legally reduce tax obligations

- Assistance with tax planning and registration

- Submitting your self-employed tax returns on time and accurately

- Clear, set prices without any additional costs

- If necessary, assistance with tax penalty appeals and payment arrangements

- This keeps your tax affairs in order, allowing you to focus on managing your business.

With customized solutions for individuals across various industries, Quick Tax Returns provides self-employed clients with long-term value and peace of mind by organizing their tax affairs, allowing them to focus on running their businesses.

Summary: Plan, Keep Records, and Stay Informed for 2025

The key to saving money on self-employment taxes is to stay organized, understand your allowable expenses, stay up-to-date with the latest regulations, and file your taxes promptly. You can take charge of your finances and lower your risk of unanticipated costs or penalties by beginning your tax planning early.

The correct guidance and assistance can significantly impact the accuracy and savings of your tax return if you work for yourself. To ensure your peace of mind, please ensure that you meet the deadline of January 31, 2026, for the 2024–2025 tax year.

FAQs About Self-Employed Tax Returns and Saving Money in 2025

Q1: When is the deadline for filing self-employed tax returns for the 2024/25 tax year?

January 31, 2026, is the last day to electronically file your self-assessment tax return and make any required tax payments.

Q2: What happens if I file my tax return late?

If your return is up to three months late, you will automatically incur a £100 penalty. If you are late for more than three, six, or twelve months, the penalties become more severe. Late payments are also subject to interest.

Q3: Are business expenses deductible?

Yes, provided that they are used solely and exclusively for business. To support claims, documentation of these costs must be kept, including receipts.

Q4: Can I claim tax relief on the use of my home as an office?

Yes, you can deduct a portion of your household expenses related to the time and space you use for work.

Q5: What is the difference between allowable expenses and capital allowances?

Capital allowances are related to larger purchases of business assets, whereas allowable expenses are regular costs required to operate your business (e.g., office supplies, travel).

You can save money and prevent penalties in 2025 by preparing your self-employed tax returns well in advance of the deadline and using these professional tips. The process of managing your self-employment taxes can be made easier and more economical with the correct information, planning, and possibly expert advice.